Learning How to Read a Stock Option Chain...

This lesson will walk you through a step-by-step process of understanding a stock option chain.

But first...what is an option chain?

An option chain is a list of all the stock option contracts available for a given security (stock).

Learning how to read an option chain is a vital component to options trading. Many traders lose money because they don't fully understand option chains.

There are only 2 types of stock option contracts, Puts and Calls, so an option chain is essentially a list of all the Puts and Calls available for the particular stock you're looking at.

Now that wasn't so hard to understand was it? Well the confusing part comes when you actually pull up a stock option chain.

All that easy-to-understand information suddenly gets lost in translation and you're left looking at a table full of numbers and symbols that make absolutely no sense at all.

Before you learn how to read an option chain, let's do a quick recap of the 7 step trading process thus far:

- You've used the Investor's Business Daily (IBD) to find a list of good stocks to buy (Step 1).

- You've looked at the stock charts of those stocks and if you like what you see you add it to your stock watch list until you reach a list size of 50-100 stocks (Step 2).

- You've used a bit of stock trend analysis to review your stock charts on a daily or weekly basis. This process is used to find potential trades (Step 3).

- After you've found a potential trade, you look over the option chain and pre-select the option you're going to buy or sell. This begins Step 4: The Stock Option Chain.

How to Read a Stock Option Chain...

Part of the confusion in understanding option chains is that every option chain looks different.

If you go to Yahoo, MSN, CBOE, or your brokerage account and pull up an option quote, you will notice that the layout of each of their option chains is completely different.

They all essentially have the same information displayed, but look completely different.

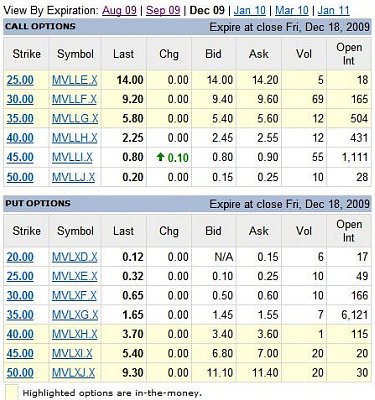

Let's use a snippet of the stock option chain listed above, which is a Yahoo stock option chain of the stock symbol "MV":

Expiration Months

As you can see from the picture there are several different expiration months listed horizontally across the top of the option chain (Aug 09, Sep 09, Dec 09, etc.). For our example we are looking at all the call and put options that expire the 3rd week of December 2009.

Some traders want to stay in a trade 1 week, some want to stay in a trade 2 months, so your trading plan will dictate which month you look at.

I like to give myself plenty of time for the trade to work out so I always try to look at options that expire 2-6 months from the current date.

Calls Options and Put Options

Each stock option chain will list out all the call options and all the put options for the particular stock. Depending on which option chain you are looking at, the call options may be listed above the put options or sometimes the calls and puts are listed side-by-side.

Strike

The first column lists all of the different strike prices of the stock that you can trade. The strike/exercise price of an option is the "price" at which the stock will be bought or sold when the option is exercised.

Symbol

The second column lists all of the different ticker/trading symbols for each stock option.

"MVLLE.X" is the ticker symbol for the 09 December 25 call option. The symbol identifies 4 things: which stock this option belongs to, what the strike price is, what month it expires in, and if it is a call or a put option.

Last

The third column lists the last price at which an option was traded (was opened or closed). It's the price at which the transaction took place. Be aware that this transaction could have been minutes, days, or weeks ago, and may not reflect the current market price.

Change (Chg)

The fourth column lists the change in the options price. It shows how much the option price has risen or fallen since the previous day's close.

Bid

The Bid price is the price that a buyer is willing to pay for that particular stock option. It's like buying a home at an auction, you bid (offer) what you are willing to pay for the home.

When you are selling an option contract, this is usually the price you will receive for the stock option.

Ask

The Ask price is the price that a seller is willing to accept for that particular stock option. This is the price the seller is "asking" for.

So when you are buying an option contract this is usually the price you will pay for the stock option.

BE CAREFUL: remember one stock option contract controls 100 shares of stock. So whatever Bid/Ask price you see has to be multiplied by 100. This will be the actual cost of the contract.

Volume (Vol)

List how many stock option contracts were traded throughout the day.

Open Interest (Open Int)

This column lists the total number of option contracts still outstanding. These are contracts that have not been exercised, closed, or expired. The higher the open interest, the easier it will be to buy or sell the stock option because it means a great deal of traders are trading this stock option.

Module Recap...

In one of the previous lessons you performed stock trend analysis to find trades. Let's pretend you found a potential trade. You then look over the option chain and pre-select the option you're going to buy or sell.

When you are looking at the stock option chain there are 7 factors that will affect what stock option you choose:

Direction

You're either going to look at the Call option or the Put option portion of the option chain. If your analysis tells you that the stock is going to rise higher, you evaluate the Call option portion of the option chain. And vice versa for Put options.

Duration

The next step is to figure out how long you plan on staying in the trade. If you want to give the trade 2 months to work out, then you look for options that are going to expire 3 months out.

Why 3 months out? It's because the options time value decays rapidly the last 30 days of it's life.

At-the-Money (ATM)

This rule is simple. You're going to pick the At-the-Money (ATM) stock option. This rule was also covered in the strike price lesson.

Can you afford the option

If you can't afford the ATM option, then you can look for a closer expiration month or move on and find a trade on a stock where you can afford the stock options.

Open Interest

Only buy stock options with an open interest of 100 or higher. This ensures that there are enough people trading the option to make it worth your time. The more people trading the stock option, the easier it will be to buy and sell the option.

Comparison Shopping

Here you simply look for the best value. Check out the price of stock options for other expiration months and see if you can find a good deal. Maybe you will find a stock option that expires 2 months later, but only costs a few dollars more.

The Bid/Ask spread

You want to make sure the Bid/Ask spread is small (for ex. $4/4.2). If it's too wide ($4/$5) then it may mean that this stock option is not in much demand. Also keep in mind that you have to multiply the cost by 100. So $4/.2 is a difference of $20 and $4/$5 is a difference of $100.

In the next lesson, you'll see how all of this plays out in a real trade.

The Passive Stock Options Trading Book Series

Discover how to achieve financial freedom in only 5 years...

Read what others have to say about the book. [Amazon affiliate link]

If You're Looking For A Reliable Lower Risk Way To Be

Profitable With Options, Try The "Buffett Strategy"...

I don't know what has brought you to my page. Maybe you are interested in options to help you reduce the risk of your other stock market holdings.

Maybe you are looking for a way to generate a little additional income for retirement. Or maybe you've just heard about options, you're not sure what they are, and you want a simple step-by-step guide to understanding them and getting started with them.

I have no idea if options are even right for you, but I do promise to show you what has worked for me and the exact steps I've taken to use them to earn additional income, protect my investments, and to experience freedom in my life.

If you want to learn more, I invite you to download a FREE video case study on how to trade options like Warren Buffett.

Inside you will discover...

- How investors pay me money to buy their stock.

- How "combining option selling with option buying" resulted in a 60% growth of my account.

- The "Family Freedom Fund" strategy I use to beat the market each year (I'm an experienced investor so your results may vary).

- And lastly, there is a high risk way to trade options and a low risk way. You'll discover a low risk "sleep well at night" method of investing.

Fill in your details below to download your FREE case study. Along with your case study, you'll also get my daily emails where I share my favorite option trading strategies, examples of the trades I'm currently in, and ways to protect your investments in any market.

Wealth Building Resources

Free Video Case Study (Newsletter)

Options Trading Made Simple Book (My Kindle book)

Options Wealth Academy (High End Training Program co-founded by Travis)

Free Options Course Learning Modules

|

Module 1: Option Basics |

Module 2: Option Value |

Module 3: Basic Strategies |

|

Module 4: Stock Charts |

Module 5: Technical Indicators |

Module 6: The 7-step process I use to trade stock options |

Learn Stock Options Trading Home Page