Out of the Money Options: a cheaper way to enter the world of stock option investing...

Out of the money options (OTM) are a cheap, but risky way to enter the world of stock option investing. Learn the best strike price for beginners.

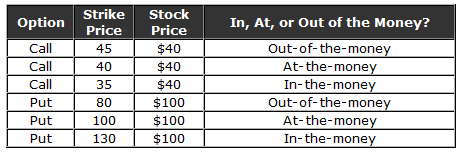

When you hear people talk about out of the money options they are referring to the relationship between the stock's price and the strike price of the option.

The strike price (or exercise price) is part of the option contract and does not change, however the stock price fluctuates on a daily basis.

The value of the stock option will change if the stock price goes above or below the strike price.

So in essence the term "out of the money" is a way to describe the value an option holds to its owner.

For call options an "out of the money option" would be a contract where the strike price is higher than the current price of the stock.

For put options it's when the strike price is lower than the current price of the stock.

For example: Let's say we bought a call option with a strike price of $65. If you know the definition of a call option, this contract gives us the right to buy the stock for $65.

Let's also say the stock that is related to this option was "trading" at $50 on the open market. So if you exercised that call option you would buy the stock for $65.

Of course you wouldn't do that because you would immediately be at a $15 loss (65 – 50).

Thus the term "out of the money"; there is no value in exercising these contracts. If you exercised the option right now you would be "out of money" (you will lose money).

It essentially means that you will lose money if you exercise the contract. As an options trader we aren't concerned with exercising options (we just buy and sell them), but you need to understand the term out of the money.

It's the same reason people don't sell their homes when the value of the home is less than what they owe on the loan.

If they sold their home they would be "out of money".

They wouldn't make any money, so selling the home is of no value.

And guess what? If none of this makes sense don't worry.

Stock option investing is a skill that takes time. I felt dumb for like 6 months until one day I "got it" so stay encouraged and keep learning.

Trading Out of the Money...

Trading OTM options is a very aggressive options trading strategy and is only recommended for experienced option traders.

New traders often learn about options trading and trade the out of the money option because it's cheaper. It's cheap for a reason!

It will take a large move in the stock price before those options gain significant value. If the stock moves, the rewards are great, but if it doesn't then you lose money quickly because the time value of the option erodes away.

I'm a keep it simple kind of person so that's why I recommend new traders pick the at-the-money option until they become more experienced with options trading.

It's just an easy rule of thumb to remember.

The Passive Stock Options Trading Book Series

Discover how to achieve financial freedom in only 5 years...

Read what others have to say about the book. [Amazon affiliate link]

If You're Looking For A Reliable Lower Risk Way To Be

Profitable With Options, Try The "Buffett Strategy"...

I don't know what has brought you to my page. Maybe you are interested in options to help you reduce the risk of your other stock market holdings.

Maybe you are looking for a way to generate a little additional income for retirement. Or maybe you've just heard about options, you're not sure what they are, and you want a simple step-by-step guide to understanding them and getting started with them.

I have no idea if options are even right for you, but I do promise to show you what has worked for me and the exact steps I've taken to use them to earn additional income, protect my investments, and to experience freedom in my life.

If you want to learn more, I invite you to download a FREE video case study on how to trade options like Warren Buffett.

Inside you will discover...

- How investors pay me money to buy their stock.

- How "combining option selling with option buying" resulted in a 60% growth of my account.

- The "Family Freedom Fund" strategy I use to beat the market each year (I'm an experienced investor so your results may vary).

- And lastly, there is a high risk way to trade options and a low risk way. You'll discover a low risk "sleep well at night" method of investing.

Fill in your details below to download your FREE case study. Along with your case study, you'll also get my daily emails where I share my favorite option trading strategies, examples of the trades I'm currently in, and ways to protect your investments in any market.

Wealth Building Resources

Free Video Case Study (Newsletter)

Options Trading Made Simple Book (My Kindle book)

Options Wealth Academy (High End Training Program co-founded by Travis)

Free Options Course Learning Modules

|

Module 1: Option Basics |

Module 2: Option Value |

Module 3: Basic Strategies |

|

Module 4: Stock Charts |

Module 5: Technical Indicators |

Module 6: The 7-step process I use to trade stock options |

Learn Stock Options Trading Home Page