Buying a Protective Put: how to protect yourself from losing money...

The Protective Put and the Married Put are essentially the same in that they protect you from the risk of loss. What differentiates the two is that a Protective Put is when an investor buys a Put option for shares of stock he/she already owns.

It's considered protective because investors use this strategy to protect profits they have accumulated in a trade. And like the Married Put it's also used to insure (hedge) the investor against a loss in trading capital (money).

Protective Put Example...

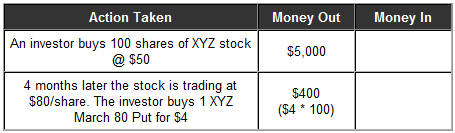

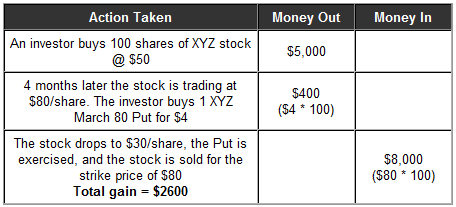

Suppose you had initially purchased 100 shares of stock XYZ @ $50 per share. Excluding commissions it would have cost you $5,000 ($50 *100). Four months later the stock is now trading at $80. You have an unrealized profit of $3000.

Usually you would have to sell shares of the stock to lock in your profits. This however prevents you from fully participating in a future rise of the stock price for all 100 shares.

Buying a Protective Put solves this dilemma. It protects your unrealized profits so that you don't have to sell any shares of the stock.

Remember that a Put option gives its owner the right, but not the obligation, to sell a certain stock at a specified price on or before a specified date.

Instead of selling shares you would buy a Put option (Your Protection) with a strike price of $80. You've now locked in your gains and have the "right to sell your stock" for $80. And like any type of insurance, you have to pay a premium (the cost of the option). The Put option cost you $400 ($4 *100).

You've essentially insured yourself against a loss. Even if the stock price fell all the way to $30, you'd still have the right to sell the stock at $80 up until the day the Put option expires.

***Profit Calculations:***

You paid a total of $5400 ($5000 for the stock and $400 for the Put option).

You sold 100 shares at $80 and received $8000 in your account.

$8000-$5400 = $2600 gain.

So if you are following the example, you can see that a Protective Put limits the amount of money you can lose on a stock investment, but still allows you to participate in the unlimited upside potential.

Rolling Up Your Options...

If the price of the stock continues to rise past $80 you might want to sell the option you bought and then buy another one at a higher strike price.

This way you can lock in the profits from the move higher. This is considered rolling up your options.

So if the stock jumps from $80 to $110, the $80 Put option you bought wouldn't be as useful to you anymore because it doesn't provide adequate coverage against a lost in value. It's like being under insured. So it would be wise to roll up your $80 Put and buy a $110 Put.

Of course the cost of the Put eats into some of your gains, but the stock is now trading for $110. You initially paid $50 for the stock. You're attempting to lock in your unrealized gain of $6,000. So even if the total cost of both puts was $800, it was worth the cost.

Worse case scenario you end up with a profit of $5,200 ($6000-$800).

Without the protection (Put) you would be at risk of losing not only your unrealized gain of $6000, but also your initial $5000 investment.

If you're like me and have had a stock go to $0 on you, then you will also appreciate the benefit that a Put option offers. In this case the cost of the Put would be negligible.

To adequately protect your profits you need to purchase a number of Put contracts equivalent to the number of shares held. Please see the Married Put example for a full explanation of how many contracts to buy.

Advantages of Protective Puts...

- Allows you to hold on to your stocks and participate in the upside potential while at the same time insuring against any losses

- The cost to buy the insurance is relatively cheap considering how much money you are protecting

Disadvantages of Protective Puts...

- Cost of the Put option eats into your profit

- The option has a limited lifespan (it expires) and has to keep being renewed (buying another option)

Lesson Review and an Example...

A Protective Put is when an investor purchases a Put option for shares of stock he/she already owns. It is used to protect profits that have accumulated in a trade.

- Establishing this protective position is what the investment community would consider as hedging your investment.

- The Put option is used lock in your stock gains while providing you with insurance against a stock market loss.

- Purchase a number of Put contracts equivalent to the number of shares held.

The Passive Stock Options Trading Book Series

Discover how to achieve financial freedom in only 5 years...

Read what others have to say about the book. [Amazon affiliate link]

If You're Looking For A Reliable Lower Risk Way To Be

Profitable With Options, Try The "Buffett Strategy"...

I don't know what has brought you to my page. Maybe you are interested in options to help you reduce the risk of your other stock market holdings.

Maybe you are looking for a way to generate a little additional income for retirement. Or maybe you've just heard about options, you're not sure what they are, and you want a simple step-by-step guide to understanding them and getting started with them.

I have no idea if options are even right for you, but I do promise to show you what has worked for me and the exact steps I've taken to use them to earn additional income, protect my investments, and to experience freedom in my life.

If you want to learn more, I invite you to download a FREE video case study on how to trade options like Warren Buffett.

Inside you will discover...

- How investors pay me money to buy their stock.

- How "combining option selling with option buying" resulted in a 60% growth of my account.

- The "Family Freedom Fund" strategy I use to beat the market each year (I'm an experienced investor so your results may vary).

- And lastly, there is a high risk way to trade options and a low risk way. You'll discover a low risk "sleep well at night" method of investing.

Fill in your details below to download your FREE case study. Along with your case study, you'll also get my daily emails where I share my favorite option trading strategies, examples of the trades I'm currently in, and ways to protect your investments in any market.

Wealth Building Resources

Free Video Case Study (Newsletter)

Options Trading Made Simple Book (My Kindle book)

Options Wealth Academy (High End Training Program co-founded by Travis)

Free Options Course Learning Modules

|

Module 1: Option Basics |

Module 2: Option Value |

Module 3: Basic Strategies |

|

Module 4: Stock Charts |

Module 5: Technical Indicators |

Module 6: The 7-step process I use to trade stock options |

Learn Stock Options Trading Home Page