Stock Option Volatility: the danger of chasing stocks that take off in price...

Stock option volatility is the last pricing component we will be discussing in this module.

Volatility in and of itself is a measure of price movement over a given period of time. A measure of how much a stocks price moves up and down.

Stocks with high volatility have wild up and down price swings, and low volatile stocks have slow and steady price movement.

High Volatility...

Low Volatility...

Option Volatility is a measure of risk/uncertainty.

The more volatile a stock is, the higher the options premium will be. The difficulty of predicting the behavior of a volatile stock commands a higher price for the option because of the additional risk/reward it poses.

High volatility: higher option premium

Low volatility: lower option premium

2 Components of Option Volatility...

Option volatility is broken down into two components:

- Historical Volatility: tells us how volatile something has been in the past.

- Implied Volatility: is the market's view on how volatile things will be in the future.

These two components are combined and priced into the volatility portion of the options premium.

**Side Note** I'm sure you can already gather from Lesson 1 up until now the complexity of option pricing. The complexity of option pricing usually discourages a lot of people from learning about options.

I encourage you not to give up because things seem confusing.

I literally stayed confused for about 6 months when I first started and then one day things just snapped together in my brain. The light bulb went off so to speak. It may take awhile for everything to sink in, but once it does this will be second hand nature for you.

Option Volatility When You're in a Trade...

If you don't fully understand how option volatility affects the price of an option, then you may have 10-50% price swings in the option price in one day and it will freak you out.

Without the understanding it's hard to watch a $1,000 investment go up in value to $1,500 and then an hour later it's only worth $700.

If a stock has been trending at a slow and steady rate and then for 2 days it starts to become very volatile, the value of those options will "usually" increase.

If you are already in the trade then this is good. You can take advantage of this volatility by selling your options at a higher cost.

The only time this doesn't happen is when the expected move of the stock has already been priced into the option's value. This is due to implied volatility. So even if the stock has a violent move up or down the option may not move as much as expected.

Option Volatility Example...

Let's say you discover a stock that has just taken off in price and you feel like you're missing out on the big gains.

This large movement entices you to get into the trade. It's like a piece of chocolate that seduces you while you're on a diet.

In this case, the options you purchased were already inflated in price because as we said above, more volatility equals a higher premium.

This is an example of what they call "chasing strength". It's like buying a train ticket and chasing down a train after it has already left the station.

You've already missed out on the "big move," but now you're hoping that it keeps going. If it does great, you get to make some good money but if it doesn't...

You will lose money!

Remember lower volatility equals a lower option premium. When you bought the option the price was inflated because of the recent activity (high volatility), but once the stock settles down the value of the option will essentially erode away.

If you are making money on the trade your profit will began to erode away.

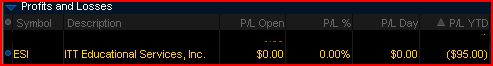

I often use my losing trades to show you what "not" to do. Well I shamefully admit that I chased the train down the railroad tracks after it had already left the station.

What can I say, even the best of us gets caught in a mistake every now and then (smile).

I won't go over the trade details just know that I chased strength and I paid the price for it. I lost $95 or -76% of the total money invested.

Final Thoughts...

Highly volatile stocks have the most potential for quick gains, however they lose money just as quickly. Low volatility stocks are more stable and produce gains the slow and steady way.

So what's my advice? Pick a trading style that fits your personality.

I prefer the slow and steady way, it's more predictable. I don't have the stomach to watch the stock and my profits go up and down and all over the place. It's too unpredictable for me.

However, when I'm looking for some excitement or looking to make a quick buck or two, I'll intentionally choose a volatile stock. Actually, that is how I raised money to pay for my wife's engagement ring and our honeymoon.

I made a few quality trades with a volatile stock and in a few weeks I was done. I made some quick money and quit while I was ahead. If you ever find yourself in the same position I'd suggest you do the same...

Please proceed to Option Greeks.

The Passive Stock Options Trading Book Series

Discover how to achieve financial freedom in only 5 years...

Read what others have to say about the book. [Amazon affiliate link]

If You're Looking For A Reliable Lower Risk Way To Be

Profitable With Options, Try The "Buffett Strategy"...

I don't know what has brought you to my page. Maybe you are interested in options to help you reduce the risk of your other stock market holdings.

Maybe you are looking for a way to generate a little additional income for retirement. Or maybe you've just heard about options, you're not sure what they are, and you want a simple step-by-step guide to understanding them and getting started with them.

I have no idea if options are even right for you, but I do promise to show you what has worked for me and the exact steps I've taken to use them to earn additional income, protect my investments, and to experience freedom in my life.

If you want to learn more, I invite you to download a FREE video case study on how to trade options like Warren Buffett.

Inside you will discover...

- How investors pay me money to buy their stock.

- How "combining option selling with option buying" resulted in a 60% growth of my account.

- The "Family Freedom Fund" strategy I use to beat the market each year (I'm an experienced investor so your results may vary).

- And lastly, there is a high risk way to trade options and a low risk way. You'll discover a low risk "sleep well at night" method of investing.

Fill in your details below to download your FREE case study. Along with your case study, you'll also get my daily emails where I share my favorite option trading strategies, examples of the trades I'm currently in, and ways to protect your investments in any market.

Wealth Building Resources

Free Video Case Study (Newsletter)

Options Trading Made Simple Book (My Kindle book)

Options Wealth Academy (High End Training Program co-founded by Travis)

Free Options Course Learning Modules

|

Module 1: Option Basics |

Module 2: Option Value |

Module 3: Basic Strategies |

|

Module 4: Stock Charts |

Module 5: Technical Indicators |

Module 6: The 7-step process I use to trade stock options |

Learn Stock Options Trading Home Page