Covered Call Options: An effortless way to earn additional income from your stock holdings...

Covered Call options are a great way to earn additional income from your stock portfolio.

By selling stock options one can realistically earn 12-24% or more on their money a year (your results will vary).

In order to learn the Covered Call strategy you have to become familiar with selling stock options.

Selling is called "writing" in the world of stock options.

I know, it would be so much simpler to just say selling, but as always, the financial community has to complicate things.

So when you hear someone talk about writing Covered Calls they are just referring to someone selling a covered call.

Before we discuss selling stock options, let me explain how Covered Calls work.

Selling Covered Call Options...

If you recall from the earlier lessons, a Call option gives its buyer the "right, but not the obligation", to buy shares of a stock at a specified price (strike price) on or before a given date (expiration date).

Selling Covered Call options is a strategy that is best used when stock prices are trending in a channel or rising slightly. It's similar to collecting rent on a house you own.

For instance, suppose you were renting your home to someone and you let them "rent with the option to buy."

The way these leases work is that the tenant pays $X a month for a set period of time and at the end of that time period they have the "option" or the "right" to buy the home.

If they choose not to buy the home then they lose out on all the rent money they paid you.

Covered Call options work somewhat the same way. You will first buy shares of stock (buy the house) and then sell or write Call options against the stock (rent your house out with an option to buy).

So if you own 100 shares of company XYZ, you would sell 1 Call option to someone giving them the "right" to purchase your stock from you. In exchange for selling these rights, the buyer is going to pay you money.

This money is yours to keep no matter what happens in the future.

If the option doesn't get exercised, you keep your stock and the money you were paid for selling the option.

When someone says, "the option was exercised," they are referring to a buyer of an option exercising his/her rights to buy (in the case of a Call) or to sell (in the case of a Put) the stock.

Let's say that the buyer in our example decides to exercise his/her rights. You are then obligated to deliver 100 shares of stock to the buyer at the set strike price.

A Stock Option Seller...

So far in all of the tutorials we talked about buying stock options. Covered call options is now where we begin to talk about being a stock option seller.

An option seller receives money from the buyer, and being an option seller, you want the stock option contract you sold to go down in value and eventually expire worthless.

This is how sellers make money. When the options expire worthless, they get to keep the options premium they collected.

So the person who buys a stock option has "rights," and the person who sells stock options has "obligations."

An option seller is obligated to fulfill the terms of the stock option contract. So in the case of Call options, you will be obligated to sell your stock if the option is exercised.

Two Forms of Selling Stock Options...

There are two styles or methods of selling stock options:

- Naked: (not covered in this lesson) the option seller does not own the underlying stock that the option is derived from. You would be selling the rights to something that you don't own. Naked option selling has significant risk and is not recommended for novice traders.

- Covered: the option seller owns the underlying stock that the option is derived from. If the person whom you sold the option to decided to exercise their rights you would just deliver to them the shares of stock you already have in your account.

With Covered Call options you already own the stock, hence the term "covered." You need to own at least 100 shares of stock to sell a Covered Call, because...

1 stock option equals, represents, or controls 100 shares of stock.

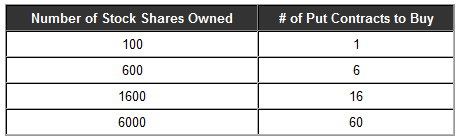

So if you're selling stock options, you have to sell 1 call option for each 100 shares that you own. Here are a few examples to help you out:

Covered Call Options in Action...

Covered call options deserve a website of their own. It's a fairly simple and straight forward strategy however, there are several ways you can utilize the strategy. The following example is meant to be an overview.

As time permits, I will either create a course or an e-book on covered calls.

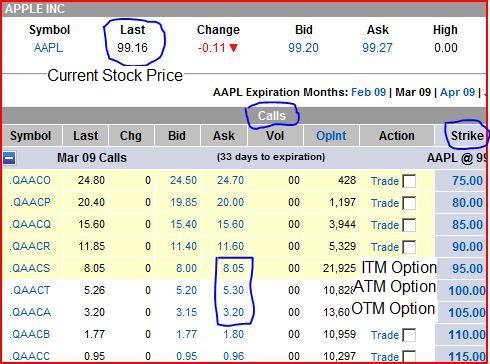

To fully understand how covered call options work, I'm going to go over an actual option chain. For this example I'm going to pull up the snapshot of the option chain that we used in the strike price lesson.

As you can see from the option chain AAPL is trading for $99 a share. Let's assume you own 330 shares of AAPL stock and you bought your shares when AAPL was trading for $80 a share.

You decide you want to earn a little extra income from your stock by selling 3 call options (covered call options). So you sell 3 contracts of the March 100 call option to someone. The price of the option was $5.30 or $530.

You always multiply the quoted price by 100.

So in exchange for selling them the right to buy your stock, they paid you a fee of $1,590 ($530 * 3 contracts).

That's it. That's how you sell a covered call. The $1,590 is yours to keep no matter what happens.

Yes, it's a bit more involved than that, but as I said before this was just an overview of the strategy. It wasn't meant to turn you into a covered call option pro.

Now What?

So is this where I tell you that you sit back and collect money month in and month out and retire a millionaire? Not hardly! If it were that easy, then everyone would be doing it.

Without going into great detail, just know that there are generally 3 things that can happen after you've sold a covered call:

[+] The option you sold will expire worthless, which just means that the person never exercised their right to buy the stock. In most cases, this is what you want to happen because you would have made some easy money.

[+] You are "called out." This is the term they use when the buyer of the option decides to exercise their rights and buys the stock. Since you sold the covered call option, you are obligated to deliver those shares to the buyer.

[+] The stock price drops like a rock and you start to panic because you can't sell your shares. Once you sell a covered call, those shares are now obligated. You can't do anything with those shares as long as that covered call is still an open trade. One way out of this situation is to buy the option back, which then frees up those shares and at this point you could sell the stock.

Selling stock options, more particularly covered call options, are what many traders use to generate monthly income from their stock holdings. Trading covered call options happens to be one of my favorite strategies and one that I feel every trader should learn about.

All of the strategies I've shown you in this module are only the basics. I recommend beginners start with the basics and then when they become successful with the basics, they can move on to more advanced strategies.

The Passive Stock Options Trading Book Series

Discover how to achieve financial freedom in only 5 years...

Read what others have to say about the book. [Amazon affiliate link]

If You're Looking For A Reliable Lower Risk Way To Be

Profitable With Options, Try The "Buffett Strategy"...

I don't know what has brought you to my page. Maybe you are interested in options to help you reduce the risk of your other stock market holdings.

Maybe you are looking for a way to generate a little additional income for retirement. Or maybe you've just heard about options, you're not sure what they are, and you want a simple step-by-step guide to understanding them and getting started with them.

I have no idea if options are even right for you, but I do promise to show you what has worked for me and the exact steps I've taken to use them to earn additional income, protect my investments, and to experience freedom in my life.

If you want to learn more, I invite you to download a FREE video case study on how to trade options like Warren Buffett.

Inside you will discover...

- How investors pay me money to buy their stock.

- How "combining option selling with option buying" resulted in a 60% growth of my account.

- The "Family Freedom Fund" strategy I use to beat the market each year (I'm an experienced investor so your results may vary).

- And lastly, there is a high risk way to trade options and a low risk way. You'll discover a low risk "sleep well at night" method of investing.

Fill in your details below to download your FREE case study. Along with your case study, you'll also get my daily emails where I share my favorite option trading strategies, examples of the trades I'm currently in, and ways to protect your investments in any market.

Wealth Building Resources

Free Video Case Study (Newsletter)

Options Trading Made Simple Book (My Kindle book)

Options Wealth Academy (High End Training Program co-founded by Travis)

Free Options Course Learning Modules

|

Module 1: Option Basics |

Module 2: Option Value |

Module 3: Basic Strategies |

|

Module 4: Stock Charts |

Module 5: Technical Indicators |

Module 6: The 7-step process I use to trade stock options |

Learn Stock Options Trading Home Page